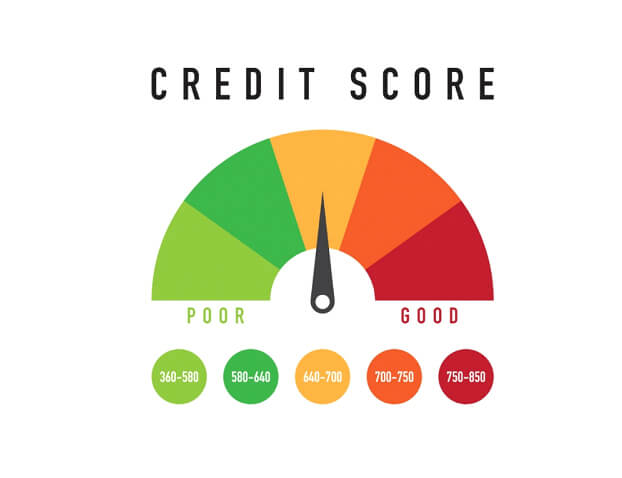

It is like feeling anguished with zero credit score, you may think of a number of reasons why you don’t have a credit score. A credit score is an essential part that can avail you of all the financial benefits when it is good.

On the other hand, you can be deprived of those benefits in case of bad credit score, you have. Almost 15% of the credit score of your credit history accounts is deemed, depending upon for how long you have used your accounts.

Or they are still on; there is a time period of 6 months for credit agencies to take for counting your credit points. If you haven’t gone through all of them neither credit nor banks. Then money lenders may think twice to give you the funds.

You need to wait and see while setting up your credit history from the initial stage because it takes time. But here what you can do, by resorting to good financial habits you can see some improvements after sometimes.

There are some helpful factors that can be responsible for erecting your credit points after resorting to them. You can go through some basics so that there can be a high possibility for the building of credit score well.

Before we assist you with those basics, we would like you to make sure to read each and everything carefully so that you can’t miss anything useful. Now let’s get started with knowing about the credit rating.

What is called a credit score?

A credit score decides your financial future because there are such borrowers who have a bad credit score due to multiple reasons. This makes them unable to get financial assistance from financial institutions during their needs.

But those who have maintained their credit score well, they can easily avail loans and other financial facilities with lower interest rates. But there are high-interest charges with bad credit so bad credit holders have to pay off such interest rates as well.

What is the method for credit score calculation?

There are credit reporting agencies that are responsible for the calculation of your credit score after acquiring details from your banks and money providers. The agencies having collected the financial details from them, they start counting the credit score based on that.

Yes, this is how your credit rating is there on your credit history which also helps the agencies for knowing the status and calculating along.

Zero credit score vs lower credit score for distinction

It is really indispensable considering between a zero credit score and a lower credit score. With lower credit rating you can’t get the approval for financial support from the financial institutions because there is a requirement to work on it for improvement.

In case you have no credit score which means there is no credit rating available, through this the agencies can’t have more of your details. There are a number of factors why this kind of situation there is, you can consider:

Here the factors are:

You are new to credit

In case of having neither credit accounts nor credit history creates obstacles for the agencies to come to the conclusion. Because they have no more details about your financial background, it can be easily seen in the case of students.

You are relocated to Canada

It doesn’t matter whether you had a credit history or not earlier. It becomes necessary to reconsider it because you will have to work on your credit history from the initial stage here.

You haven’t used your credit card yet

People generally use their credit card for avoiding paper money, but if you bring your credit card usage to a halt for a debit card. It doesn’t help credit agencies to yield information about your financial background to get credit points.

Why is credit rating required most?

As a matter of fact, without a credit score, there is no living wonderfully because funds are the supreme for making life better. A credit score can avail your profits from the financial aspects for fulfilling your needs.

We don’t know of the future, but our future knows our present that’s why it is the most important thing to maintain a credit score. Because in the end, you will need it and without it, you can be sad after getting no approval of what you applied for.

Conclusion

A credit score is like a pass to get fast approval for any sort of financial help with lower interest rates from any financial institutions. It can’t be possible getting when there will be bad credit score caused not paying regularly.

That’s why there is a requirement of good credit score which can be possible to maintain it through avoiding skipping while making payments on a regular basis. Later on, you can have financial benefits easily without facing questions further.

- How To Make A Monthly Budget And Save Money? - June 28, 2021

- What is my credit score if I have no credit? - August 21, 2020

- Christmas is coming? Here Is Everything You Need To Know About Installment Loans? - August 6, 2020